The All Aboard Newsletter

In today’s issue we’ll review growth, talk about how to impact retention, and talk a little bit about rest going into Q4.

As a favor, if you get value out of this newsletter, please consider sharing it. Whether its an agent, an office manager, or someone in the industry, I’d very much appreciate it.

Lets take a ride!

Growth Update!

*Note - After the DASH issues with reports, I’m expecting some of these numbers to slightly change*

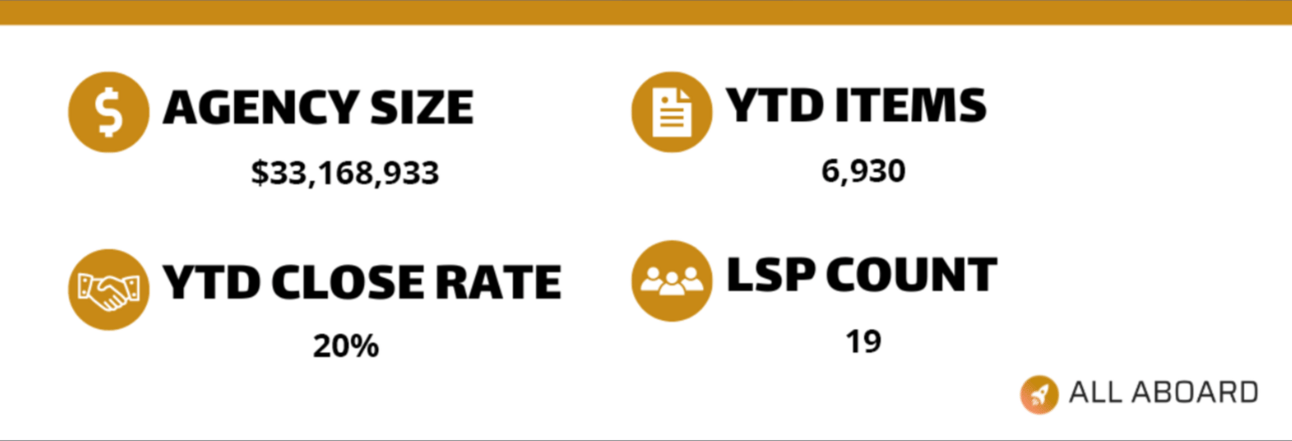

We grew by $597,950 in August!

In July, we grew by over $600,000.

So after writing over $1,000,000 in written premium in August, we expected growth to be even better.

But it wasn’t - Growth clocked in at $597,950 in premium.

This isn’t the first time we’ve seen something like this happen in 2023.

Whether its because the way premium “earns in”, the way that the reporting structure was set up, or something else, we’re still stoked on step we took forward.

That’s a lot of growth.

Annualize that growth, and we’ll grow by $7,000,000 over the next year. That type of growth would push us over the $40 million mark.

Now we need to execute.

A lot of the ability to execute on that growth will be dependent on retention improving.

In August, Auto retention improved to 81.5, which is a 0.7% improvement, and overall retention improved by 0.5% to 84.7%.

This increase in overall retention is largely driven by auto retention gains. Homeowners retention has steadily held sold between 90% and 91%, but we don’t expect that to last.

With our most recent rate increase, homeowners retention is likely to drop 2% - 3%, but hopefully the gain on auto retention cancels out the drop in home retention.

Our loss ratio improved slightly - about 0.4%, but we’re still over 3% away from the 68% mark we need to hit to qualify for our year end bonus.

And folks, we’re ready to call it curtains.

Based on what is falling off on the 12mm and 24 mm, we’ve forecasted that we need to grow about $600k per month in auto premiums.

So yea….

We don’t believe we can control it at this point, so we can’t worry about it too much.

We’re in the acceptance stage.

Bonus isn’t guaranteed. That why they call it a “bonus.” And its a great reminder on why we should try to run our agencies as profitably as possible.

Don’t go for broke chasing a bonus that might not be there at the end of the quarter/month/year.

Regardless of our 2023 results, we know loss ratio will remain a part of the bonus qualifiers for 2024.

Our efforts and initiatives to improve loss ratio will continue indefinitely.

4.0 Growth is locked in

Elite is locked in

And we’re ready to finish 2023 as strong as possible.

The mountain is getting taller for us as we prepare to enter Q4 though.

On 8/28 we took dual RMP restrictions on both the Home and Auto lines.

A week later on 9/4, we took a 12.5% rate increase on Home insurance.

So… yea… things aren’t as fun as they were last month.

Since 9/5, our NB is down 40% and we’re expecting to finish in the 700s for item production.

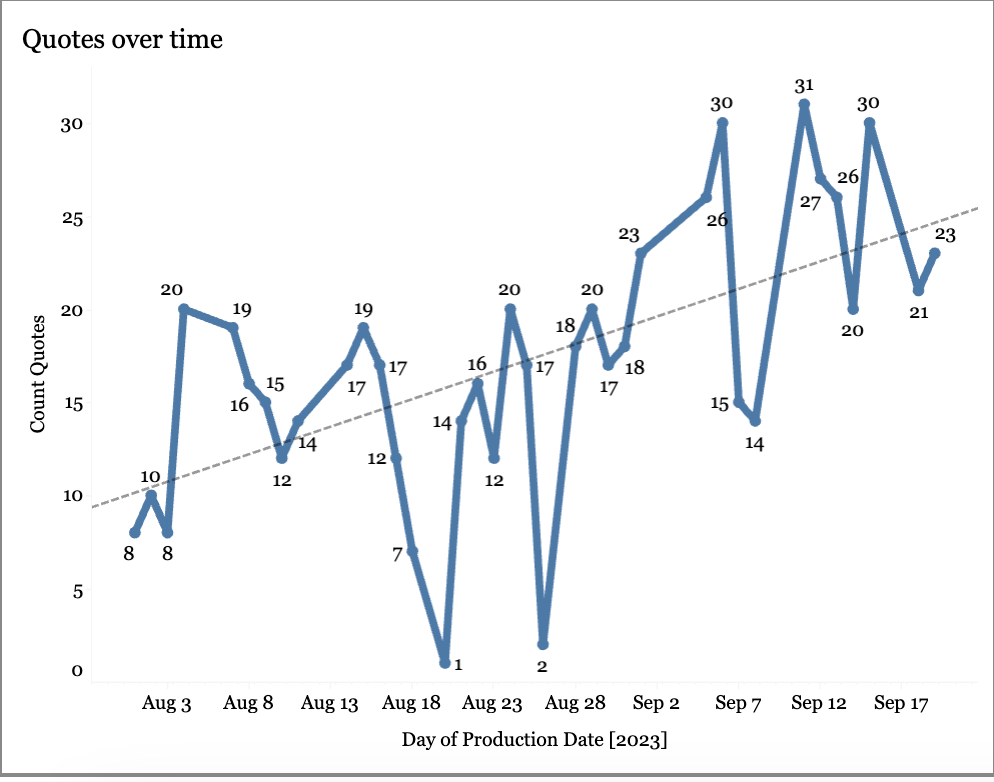

Here is an example of what we’re seeing with Non-Standard auto quotes.

Notice what happens on 9/5?

Non Standard Quotes per day since 8/1 to 9/18 - RMP Change on 8/28

So, Non-Standard is up about 30% and our DNQ rate is up about 40%.

And while its tough right now, we’re grateful that we have such a strong focus on our data strategy.

When these RMPs were announced, we split all of our marketing campaigns into new groups to help us better track competitiveness.

And every single day we’re making small tweaks and getting a little closer to getting back on track.

So while we do that, we’re going to continue doing what we do every single time we take a rate, or RMPS get adjusted.

We quote more.

Whether thats more volume of quoted households.

Or thats them finding additional lines like Umbrellas, Life, Commercial, and Toys.

Its the best way to get through it.

If close goes down, and you want to keep NB consistent. You must increase quotes. Its just math.

Here is an example:

Item close has dropped from 21% in August to 16% in September. Here is what that drop does to quotes:

1,000 Items @ 21% = 4,762 Quotes (227 per day)

1,000 Items @16% = 6,250 Quotes (297 per day)

Considering our best month ever for quotes had us average 234 quotes per day….

I don’t think 297 per day is very likely.

So we need to find a balance between increasing close rate AND increasing quotes to try to balance that gap out.

So when rates or RMPs change the best thing your team can do in the short term is to increase quote volume.

The way out, is through.

It allows you to keep moving while you adjust your marketing, and competitor rates catch up.

So, we’ve been through this before.

Last September, we took a 25% average rate on auto insurance lines.

Was it hard for a while?

Sure - but you know what happened?

The salespeople got better.

And those improved skills post-rate increase last year greatly contributed to the record year we’re having in 2023.

The best producers are made in hard markets.

The work we do today will pay dividends a few months down the road.

Can we impact retention?

I’ve said in this newsletter that I believe that 80% of retention is driven by rates.

For a long time I’ve believed that. And I’ve believed that largely because I have data to support that theory.

But now I have reason to believe we might be able to impact retention more than previously thought.

We knew last year that once rates started coming, they were likely to continue to for the foreseeable future.

We’ve been around for enough rate cycles to know how this works.

And considering that 1% of retention is worth about $30,000 in annual revenues, we have a vested interest in proving our own theory wrong.

One of the things I love most about my team is that they’re always challenging the assumptions and preconceived notions we have.

Getting it right is more important than being right.

So when I finally learned that we had enough between sales data and retention data to try and derive some insights, I was stoked.

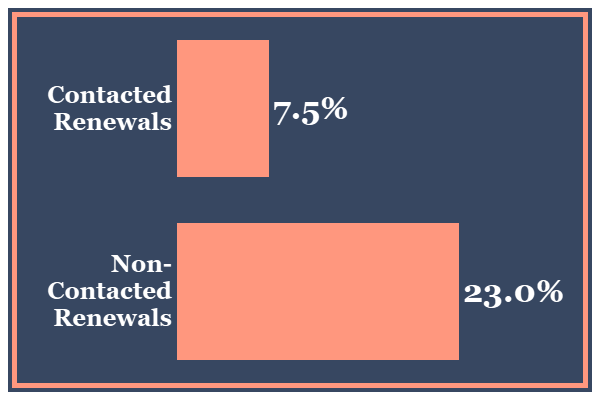

A little over a year ago, we started making outbound calls on all of our renewals.

Our main goal in starting this project was to make recommendations for clients, and increase premium on our book in the process. We felt that if these calls helped our retention, it was a cherry on top.

So the goal was simple - Call every renewal each month at least one time to try and offer a review.

We’ve always used an email drip to invite people to review their policy, but hey, who checks their email anymore?

We knew we needed to contact people in another way.

In the past when we’ve tried this, we’ve relied on our LSP to make the calls. This didn’t work. Mostly because the LSPs were spending a lot of their time listening to the phone ring and hitting voicemails.

It was a poor use of the resources we had. The LSPs were spinning their tires and getting frustrated in the process.

This time however, we decided we’d use our SDR team to make the calls.

It was the only way to ensure we called everyone.

And we deployed the same strategy that we use for sales.

One caller (SDR) to Three LSPs.

The SDR makes calls from 3pm to 4:30pm, a few days a week.

The results?

We were able to talk to about 400+ people and conduct reviews throughout the year.

The connect rate was generally good, and people were open to the review, and appreciative that we did it.

And on top of the cross-sells, platinum adds, and premium increases, we got an extra win (we think).

An improvement in retention.

When we talk to them, good things happen

So, before you say “Yeah Andrew, of course proactive reviews increase retention” I want to say… Yea I get it.

That has always been the general sentiment.

But nobody has ever been able to prove it to me, and we’ve never had any concrete data to show that would help convince us that it were true.

But now we have data. That data looks promising.

And what it says is that when:

When we contact and review, we retain at 92.5%

When we don’t contact and review, we retain at 77%

If we take it at face value, thats a hell of a win.

A 15.5% swing on retention?

At $30,000 per 1%, thats an increase in annual revenue of $465,000 assuming we could contact everyone (we can’t).

Interest = Piqued

But to be fully fair - the data analysis isn’t perfect.

And we need to tighten up our processes, and include some automation through things like texting (Hearsay).

For instance, what if the people who are open to a review are the same people who would renew at 92.5% regardless of whether they had a conversation or not?

We need to get more scientific, and while we do “score” our renewals to prioritize which ones to call first, its imperfect.

Though the data analysis is not perfect, its enough to get me excited to invest more effort and money into the outbound renewal process.

Retention lift started as an added bonus, but it might end up being the main goal in the long-run.

And if you do a review, and there are no upsell/cross-sell opportunities, and if it doesn’t impact retention, you can still ask for a referral.

That alone should drive a lot of new business into your book.

The risk is relatively low if you have the capacity to do these calls and reviews.

Just note, that this data may vary widely across companies, and markets. I am in Metro Atlanta, and most of my clients are "working age.” The service loads and needs are very different than that of say, a retiree heavy book in Florida.

What about Retention and Marketing?

I can’t tell you how many times I’ve heard:

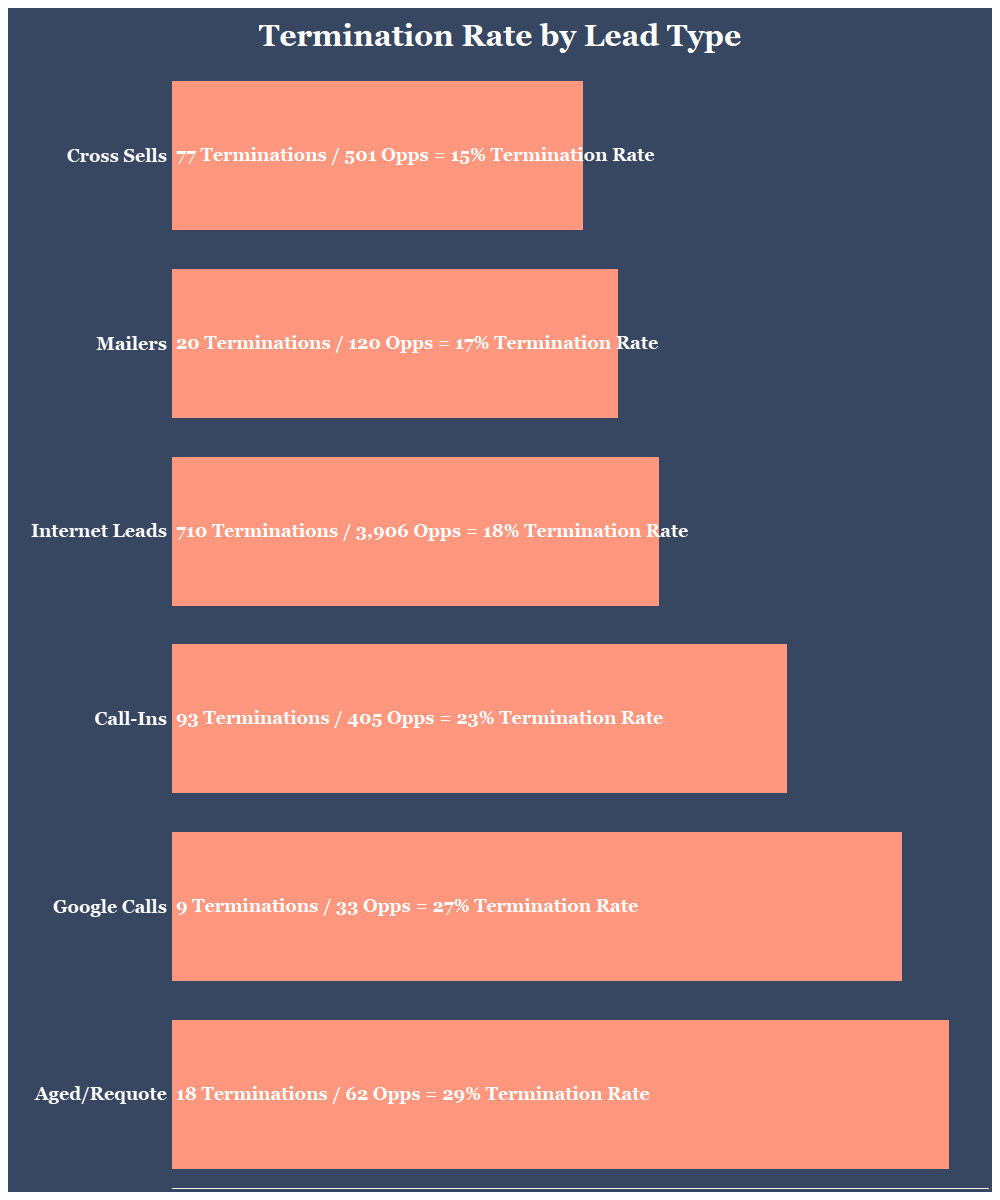

“Internet leads don’t retain. They’re the lowest retaining lead source”

It usually comes up in conversations when people who don’t like or believe in using internet leads finds out that we’ve grown almost entirely through…. Internet Leads.

This doesn’t bother me BUT I did want to know if that theory was true.

Please take note of Sample Sizes

The data surprised me.

In fact, it totally broke my perception of what was true.

I would have never expected Leads and Mailers to have roughly the same termination rate. To compound the shock, Call-Ins and Google calls retaining at a lower rate than leads was not something I expected (but it makes sense why).

I will confidently say that this data will vary across books, and across markets.

And though some sources have a higher termination rate, it doesn’t mean that I should necessarily omit those marketing tactics.

I just need to understand that they may take more work to retain, and we may need to treat them differently than a lead or mailer client.

I know that some of these samples are small, and the data can be further improved.

So, as we continue to build our agencies, keep in mind the benefits of data analysis, and then remember how important it is to build your data infrastructure.

Ask yourself “What is something that I don’t need right now, but might need later?”

For example, if your market is competitive, you might not need IS score by zip code. What happens when RMPs tighten? You’ll wish you had it.

Think about the data points you need to collect to get the answers you want.

Its never to late to start building out your data strategy.

P.S - I’ve made the recommendation to hire an analyst to several agents. Every one who has made the hire has had them pay for themselves and then some.

On my mind this week:

Rest is important - Don’t ignore it

Q4 Is coming.

Conference season is in full swing.

Before we know it, the holidays will be upon us and we’ll be marching into 2024.

The last few months of the year are always hectic.

Maybe you’re pushing for a goal. Maybe you’re planning for 2024.

Maybe you’re trying to do both at the same time.

Whatever it is, its likely stressful.

So don’t forget to take some time off and recharge the batteries before you enter this push.

When we’re tired and stressed, we can’t perform at optimal levels.

How many awful decisions have we made when we were tired?

Tons.

So get some rest, and lets finish strong!

Andrew’s Picks

Have you checked out Nick Sakha’s Youtube Channel? He interviews successful agents and provides so much value for free. Check it out - Link

I’ve recently learned some agents are crushing lead generation using FB groups. Here is a community that focuses on that (no affiliation) : Link

A few laughs around Telemarketing (NSFW - Crude Language) : Link

What did you think of this week’s newsletter - Shoot me a reply with a comment, question, feedback, or something else!

I’d love to hear from you!